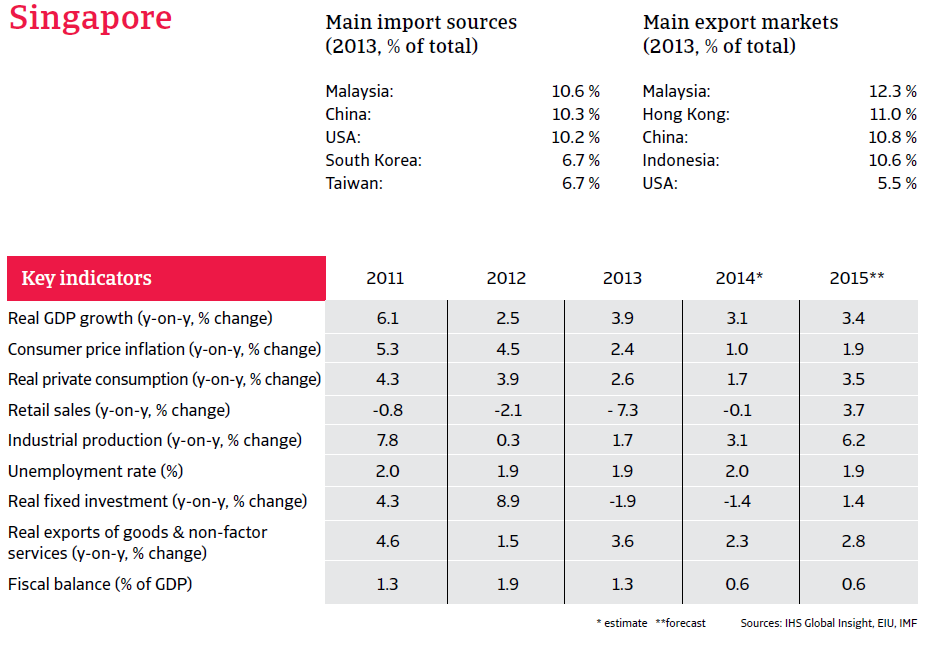

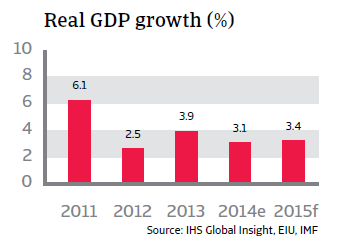

After 3.1% growth in 2014, Singapore’s economic growth is expected to accelerate to 3.4% in 2015, driven by investment; among other things, in its infrastructure.

Political situation

Head of state: President Tony Tan Keng Yam (since September 2011)

Head of government: Prime Minister Lee Hsien Loong (since August 2004)

Stable situation

The People’s Action Party (PAP) has been in power since Singapore’s independence in 1965. The PAP is business friendly but, compared to Western standards, personal freedoms are limited. The opposition is weak and fragmented and has very few opportunities to present itself in public.

Singapore’s population consists of ethnic Chinese (77%), Malays (14%), Hindu Tamil Indians (8%) and 1% of other nationalities. Income distribution is relatively equal and, in contrast to neighbouring Malaysia, racial tensions are negligible. The biggest potential threat to security is the possibility of terrorist attacks by Muslim extremists, either indigenous or from abroad.

Economic situation

Strong fundamentals remain

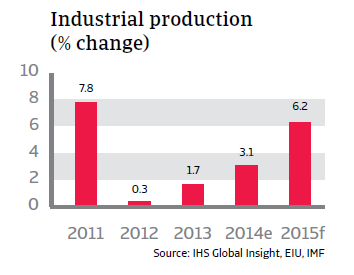

Singapore’s income per capita and level of development meet OECD standards. This city state is the main transport and financial service hub for Southeast Asia, but its economy is somewhat vulnerable because of its high reliance on demand from its trading partners and the focus on certain specific sectors such as electronics and pharmaceuticals. Nevertheless for a small state the economy is relatively well diversified. Singapore’s banking sector is healthy and adequately supervised.

The city state´s long-term growth strategy is to move away from being just a trade, transport and financial hub to become a centre of high tech industry. This strategy is starting to bear fruit in the bio-medical sector.

After 3.1% growth in 2014, Singapore’s economic growth is expected to accelerate to 3.4% in 2015, driven by investment: among other things, in its infrastructure. The city state continues to be one of the strongest countries in the world in terms of sovereign risk and macroeconomic fundamentals.

Therefore, and due to the ample foreign exchange reserves and adequate monetary management of the Singapore Monetary Authority, the exchange rate is unlikely to be affected by changing patterns of international investment.