The Spanish automotive industry continues to benefit from the on-going economic rebound of the domestic economy as well as from increasing car exports.

- Further increasing production and car registrations

- Payments take 60 days on average

- Some downside risks remain

The Spanish automotive sector is a key sector in the country’s economy, as it accounts for 10% of the Spanish industry sectors´ share of GDP and about 9% of employment. Spain is the second largest car manufacturer in Europe, after Germany, and ranks number nine globally. Nine original equipment manufacturers (OEM) are active in Spain, with a total of 17 production plants. The automotive component producers subsector plays an important role for the sector´s performance. Three of the largest car component producers worldwide are Spanish businesses, with good performance in Europe, Asia and the NAFTA region. Automotive is Spain’s second largest export industry with more than 85% of the national production exported.

In 2015 the Spanish automotive sector performed well, as production and capacity utilisation returned to pre-crisis levels. Spanish car production increased 12.7%, to more than 2.7 million units. Automotive exports increased 11.4% by units and 18% by value, to EUR 31.7 million. This upswing continued in 2016, with domestic car production increasing 11.2% year-on-year in H1 of 2016, to more than 1.6 million units, according to the Spanish car manufacturers association ANFAC. Exports increased 12.3% in H1 of 2016.

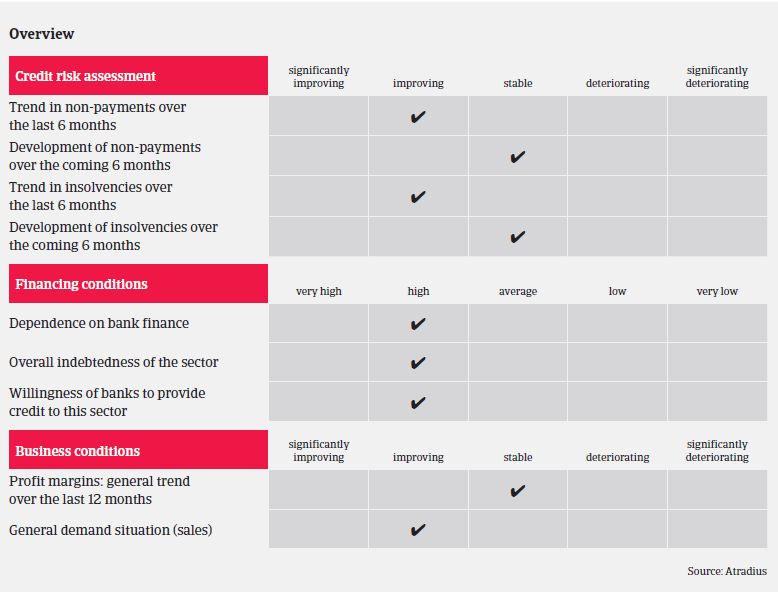

The profitability of Spanish automotive businesses has generally increased over the past 12 months, and profit margins are expected to remain stable in 2016. While external financing requirements and gearing are generally high in this sector, banks are increasingly willing to provide credit to this industry, for both short-term financing (working capital management) and long-term facilities (i.e. capital expenditure financing).

On average, payments in the Spanish automotive sector take around 60 days. Payment experience is good, and the level of protracted payments has not been overly high over the past couple of years. Non-payment notifications are low, and we do not expect major increases in the coming months due to the still positive outlook for automotive performance. The level of insolvencies in this sector is low, and this is expected to remain unchanged in the coming six months.

That said, our underwriting stance for the automotive sector has become more relaxed than in previous years. There are no major restrictions in our underwriting stance for large companies and strong international groups. However, we are still more cautious with small and medium-sized car parts suppliers who are highly geared.

相關資料

925KB PDF