The steel and metals sector remains resilient for the time being, but the market environment is turning increasingly difficult with more downside risks.

- A rebound in sales prices has helped the sector

- Payments take between 30 and 45 days on average

- More challenges ahead in the medium-term

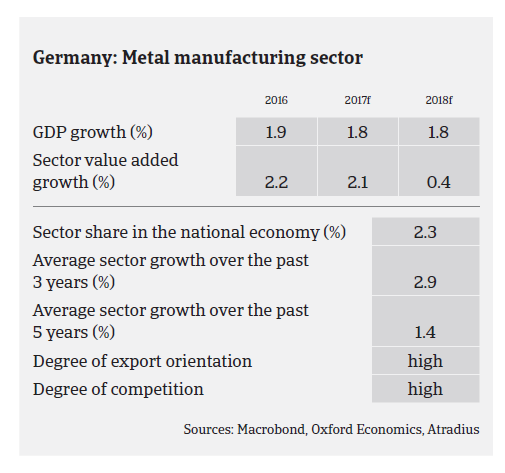

According to the World Steel Association, German steel production decreased 1.4% year-on-year in 2016, to 42.1 million tons, mainly due to low steel prices in H1 of 2016, coupled with import pressure and overcapacity. The balance sheets of many steel and metals businesses showed losses due to decreasing sales, lower margins and depreciation of inventory. However, prices have rebounded since H2 of 2016, leading to better results and improved margins since then. Steel production grew again between January and August 2017, by 2.1% year-on-year. German steel demand is expected to grow slightly, by 0.9% in 2017 and 0.4% in 2018.

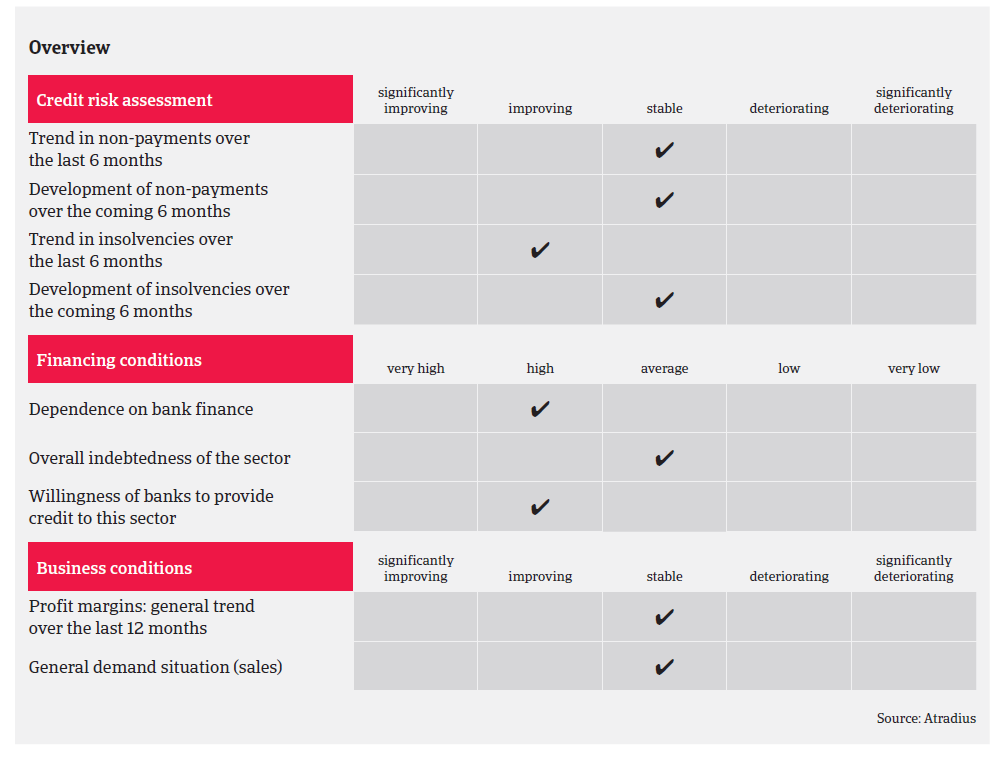

The general equity and liquidity of steel businesses in Germany are better than the manufacturing industry average, except for small wholesalers without pre-fabrication and/or steel service activities. Banks are generally willing to provide loans to the steel and metals sector.

We have seen no changes in the payment behaviour of companies in the steel and metals sector over the past couple of months, with payments taking, on average, between 30 and 45 days. In line with the overall trend, German steel and metals business failures have decreased in 2016, and no major change is expected in 2017 and into 2018.

Therefore, our underwriting stance is mainly positive for German steel and metals businesses. We pay particular attention to recent financial information (balance sheets, interim figures, bank status, payment terms, duration of contract, order volume, payment behaviour). We continue to be more cautious when underwriting small steel traders, especially those without additional business like prefabrication and weak equity ratios, as they often face strong competition and low margins. Another difficult subsector is scrap recycling where businesses are exposed to steel prices volatility and pressure on decreased margins.

For the time being, the German steel and metals sector remains resilient with a competitive edge due to its high technology products and buoyant demand from automotive, construction and machinery. However, the market environment is turning increasingly difficult, and the pressure on German steel and metals businesses has increased over the last couple of years. Besides issues like punitive tariffs and trade barriers, there are persistent structural challenges, such as volatile commodity and sales prices and overcapacities, while the number of overseas competitors from Africa, Asia and South America climbing up the value chain has increased, putting pressure on prices and margins. At the same time, the EU emission trading scheme and high energy costs in Germany threaten to increase the financial burden for German steel and metals businesses. In the medium- and long-term, decreasing demand for steel and metals from automotive, as a key buyer industry (due to a shift to electric engines and lighter car bodies), could severely affect the sector.

Therefore, majors strains cannot be ruled out for German steel and metals producers in the medium-term – with sales and profit decreases for many businesses along the value chain, coupled with a surge in payment defaults and business failures.

相關資料

1.32MB PDF